1,869.2 +/- Acres - Clay County, MN

LAND AUCTION

1,869.2 +/- Acres - Clay County, MN

Tuesday, March 11, 2025 – 10:00 a.m.

Auction Location: Courtyard by Marriott - Moorhead, MN

Auction Note: This remarkable Red River Valley cropland offering features highly productive loam soils, predominately Wheatville Silt Loam, Glyndon Loam, and Augsburg Silt Loam. Unlike heavy soils in the Red River Valley, these loam soils are among the most productive with a strong cropping history of mostly corn, soybeans, sugarbeets, and wheat. The soil diversity lends itself to a cropping rotation that significantly improves soil health.

This is one of the Valley’s most remarkable offerings of cropland this decade. This is a must consideration for farmers and ranchers. This farmland has an attractive lease in place for 2025; the buyer will receive the entire 2025 cash rent lease. The least expires at the end of the 2025 crop year. Contact Pifer’s for detailed information on cropping history and lease terms. The tenant is responsible for tilling the cropland following the 2025 harvest.

Contacts: Kevin Pifer at 701.238.5810, Jack Pifer at 701.261.4762 or Bob Pifer at 701.371.8538.

Driving Directions: Property is located north of Glyndon, MN.

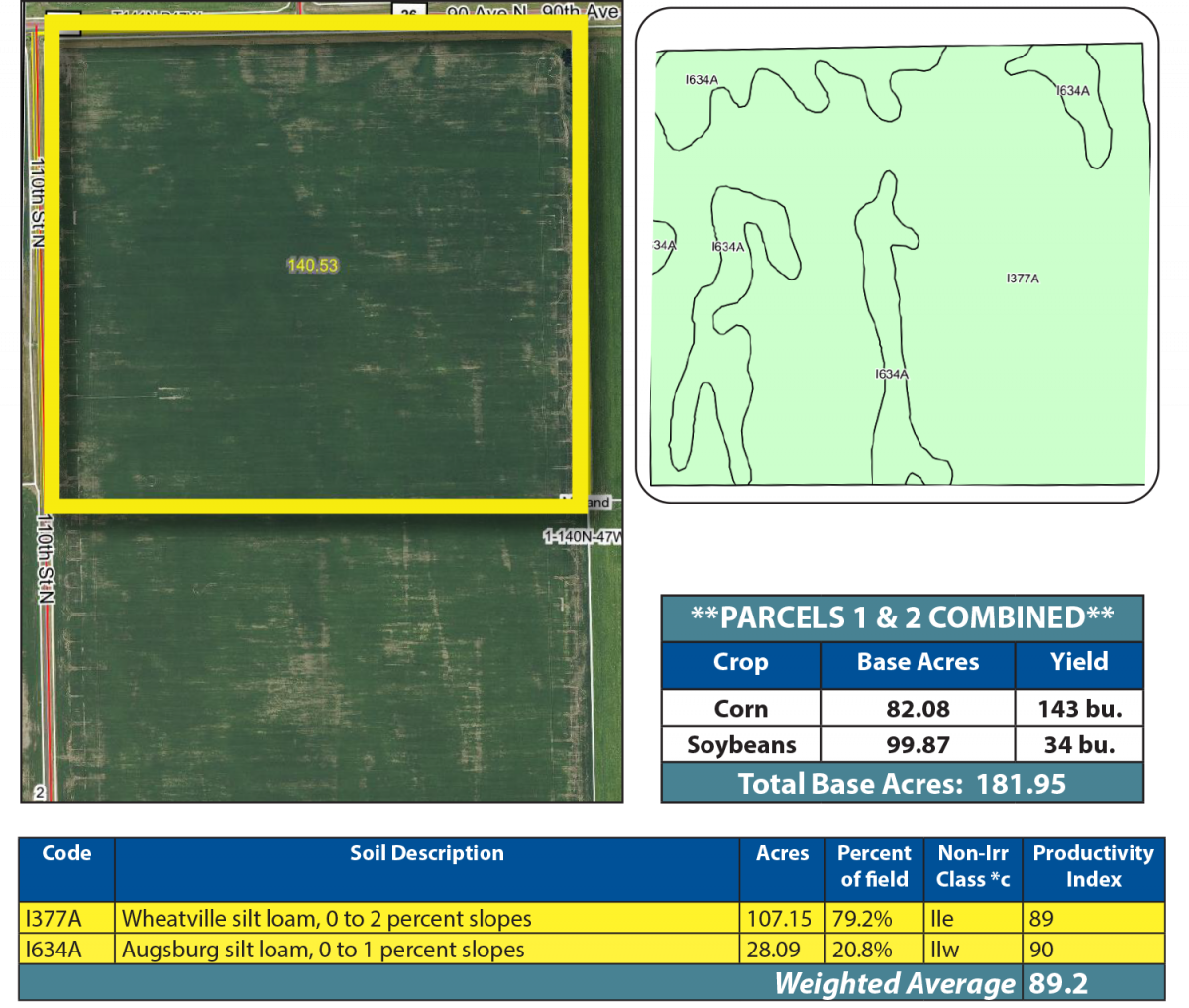

Parcel 1

Acres: 140.53 +/- (Estimate...Final Acres TBD by Survey)

Legal: NW¼ 1-140-47

FSA Crop Acres: 135.24 +/- (Estimate)

Taxes (2024): $13,392.00 (Combined with Parcel 2)

This parcel was planted to corn in 2024 and has a Soil Productivity Index (SPI) of 89.2.

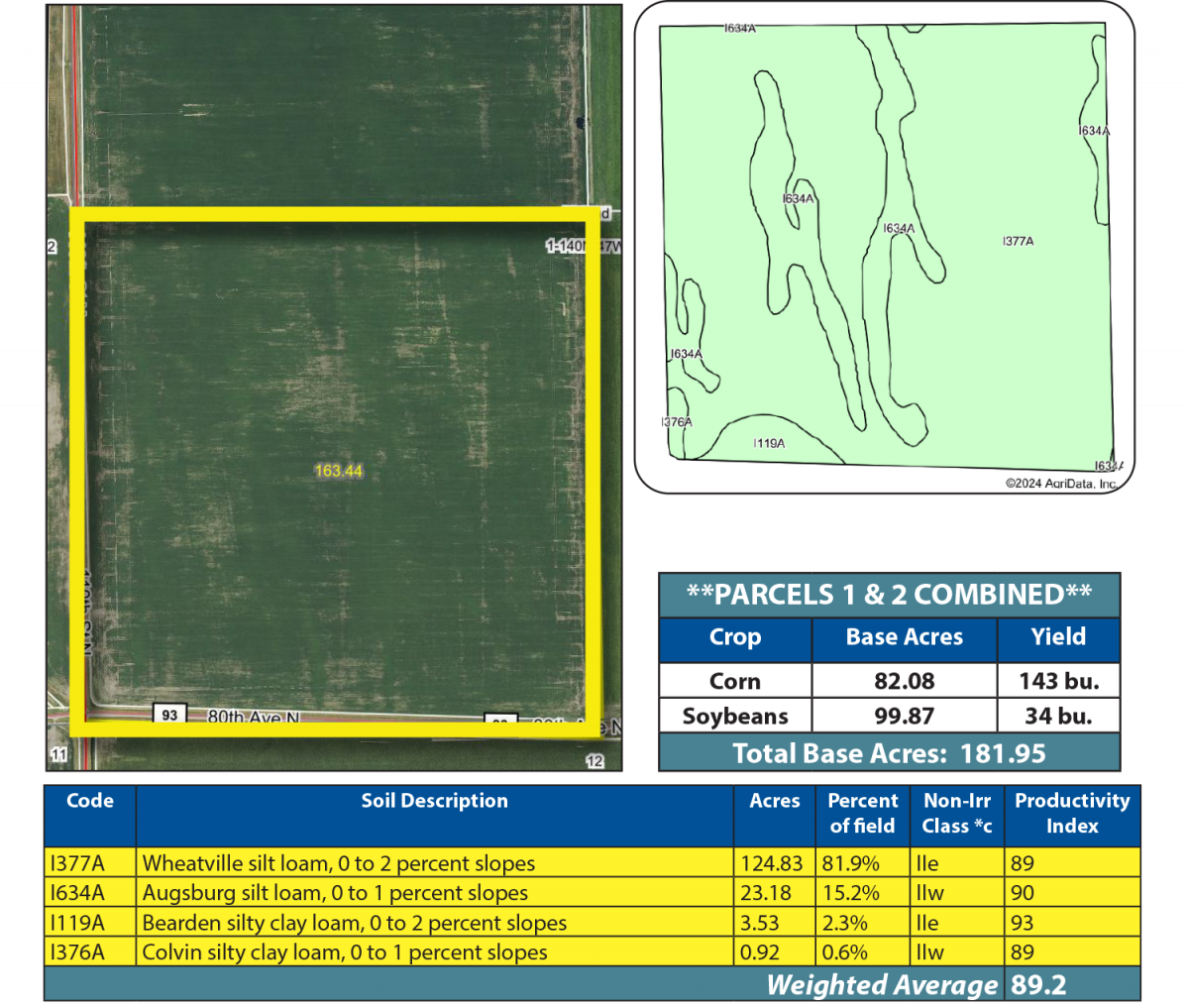

Parcel 2

Acres: 163.44 +/- (Estimate...Final Acres TBD by Survey)

Legal: SW¼ 1-140-47

FSA Crop Acres: 152.46 +/- (Estimate)

Taxes (2024): $13,392.00 (Combined with Parcel 1)

This parcel was planted to corn in 2024 and has an SPI of 89.2.

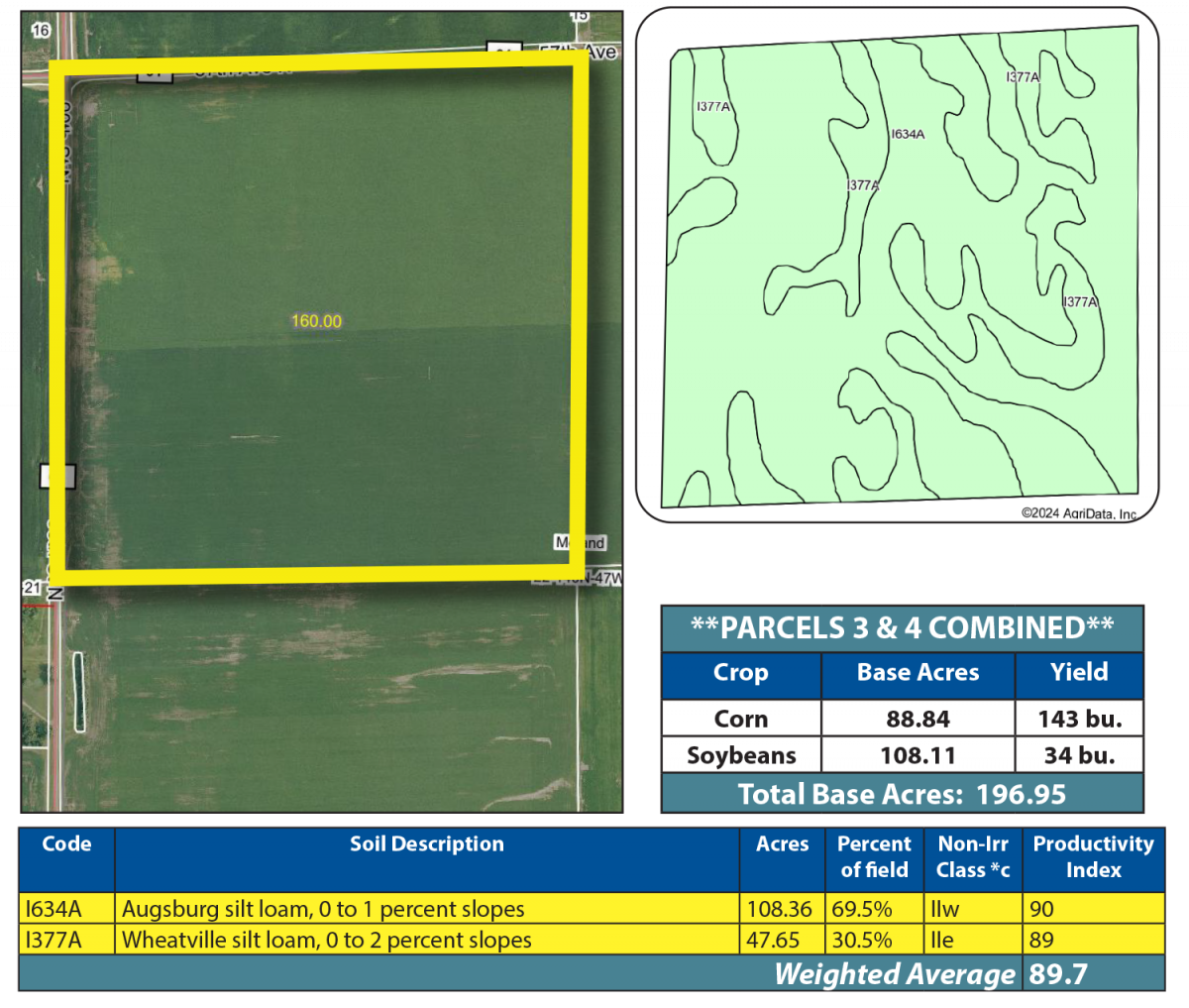

Parcel 3

Acres: 160 +/-

Legal: NW¼ 22-140-47

FSA Crop Acres: 156.01 +/- (Estimate)

Taxes (2024): $7,792.00

This parcel was planted to corn in 2024 and has an SPI of 89.7.

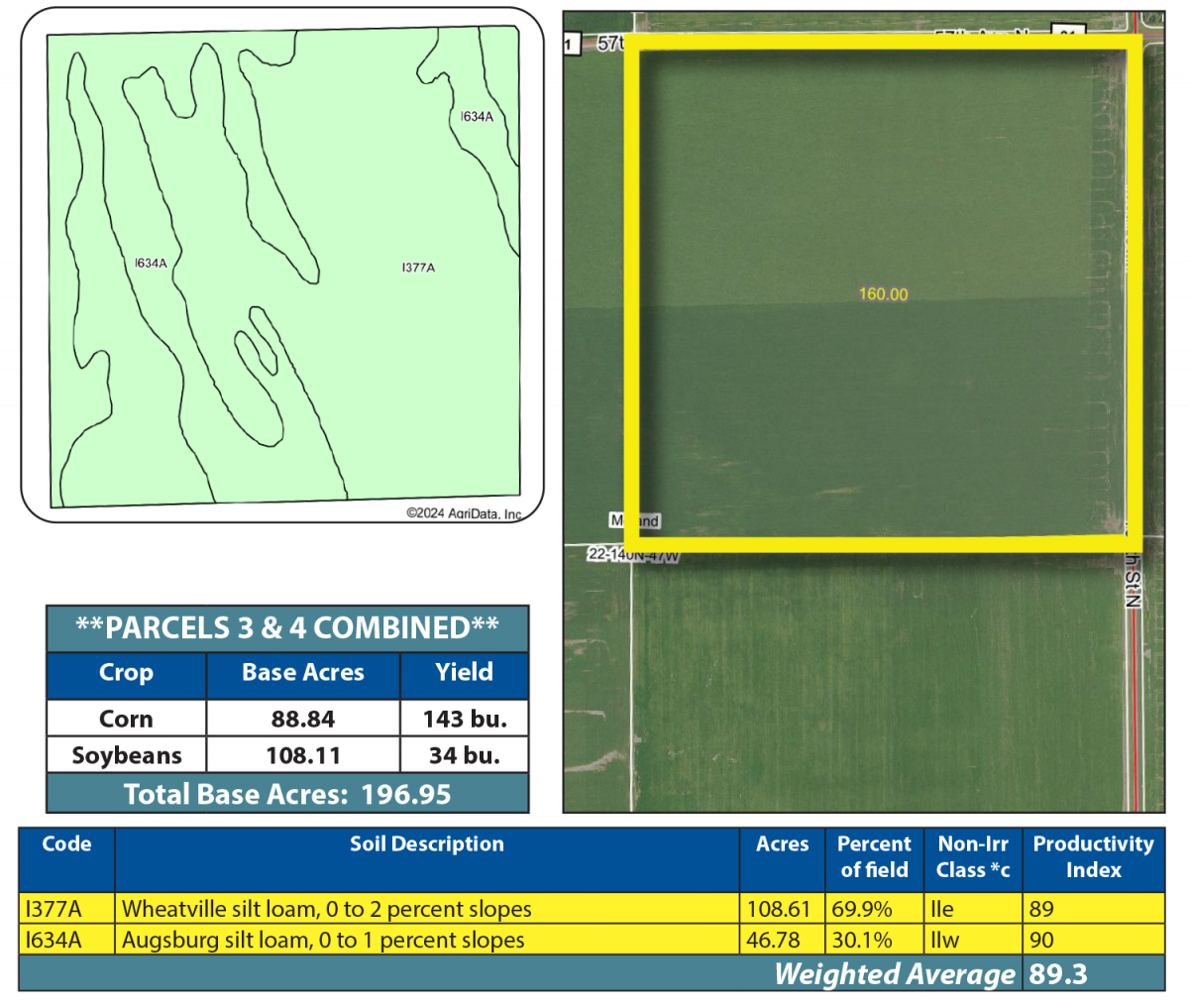

Parcel 4

Acres: 160 +/-

Legal: NE¼ 22-140-47

FSA Crop Acres: 155.39 +/- (Estimate)

Taxes (2024): $7,792.00

This parcel was planted to corn in 2024 and has an SPI of 89.3.

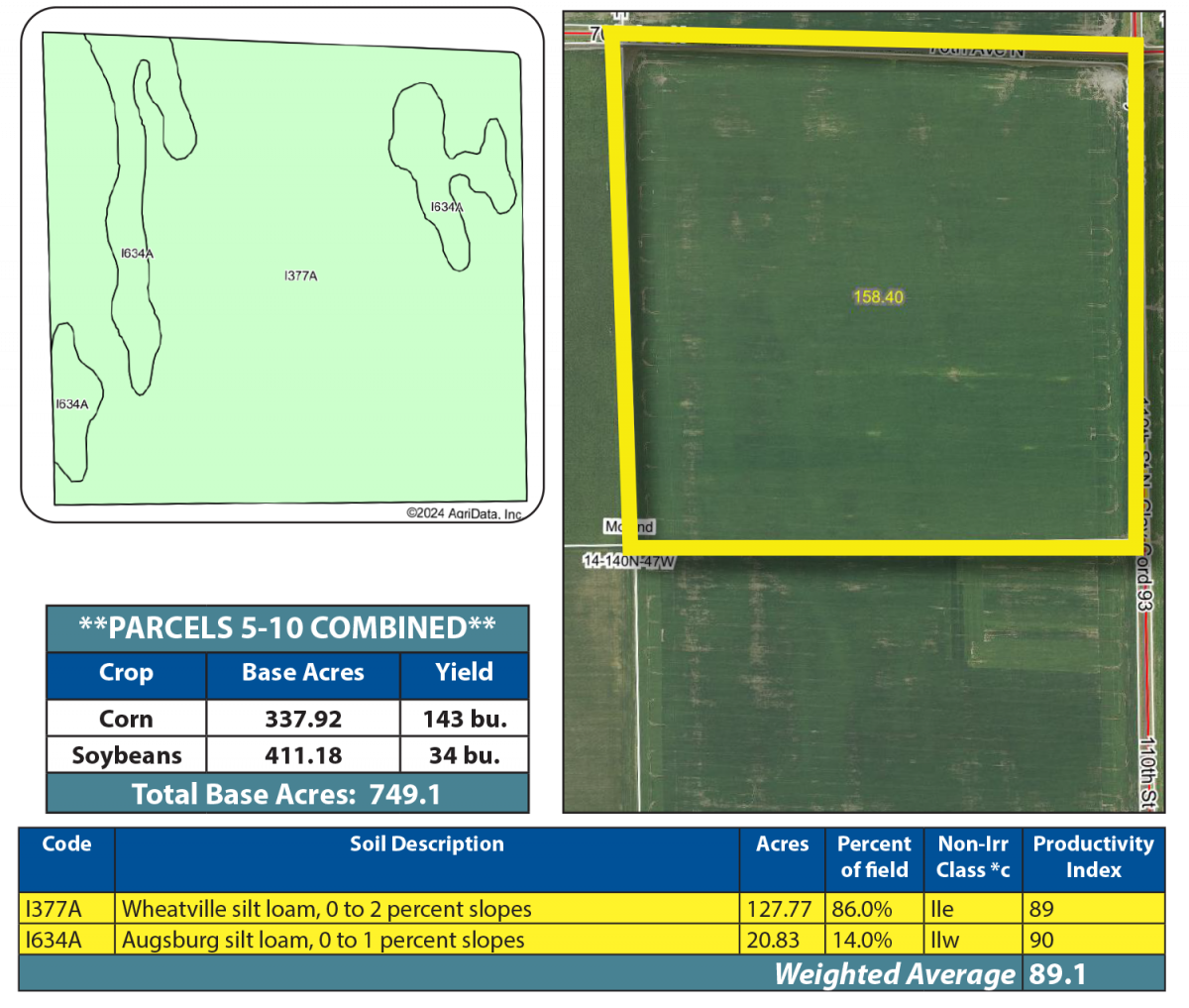

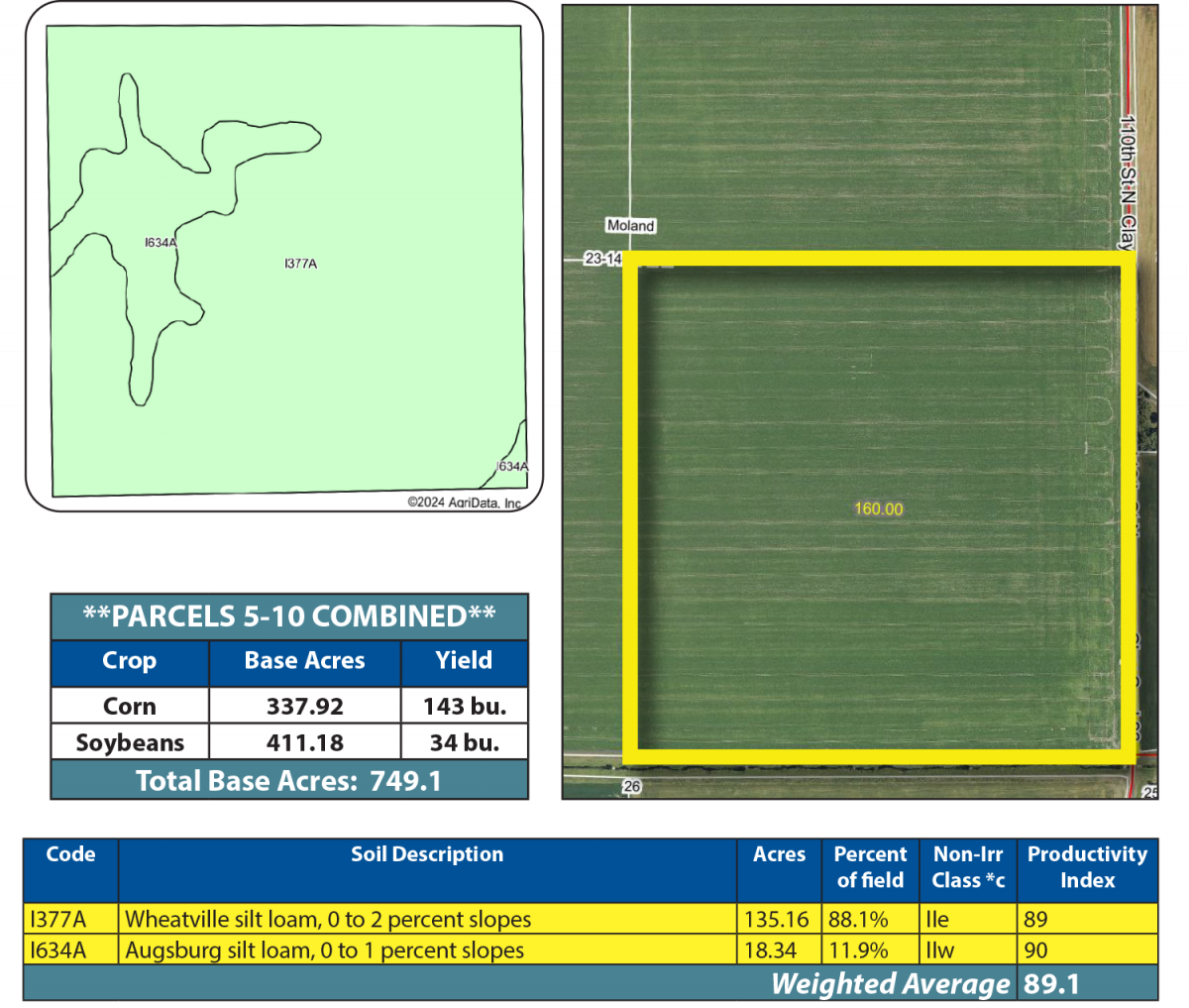

Parcel 5

Acres: 158.4 +/-

Legal: NE¼ Less Ditch 14-140-47

FSA Crop Acres: 148.6 +/-

Taxes (2024): $7,332.00

This parcel was planted to corn in 2024 and has an SPI of 89.1.

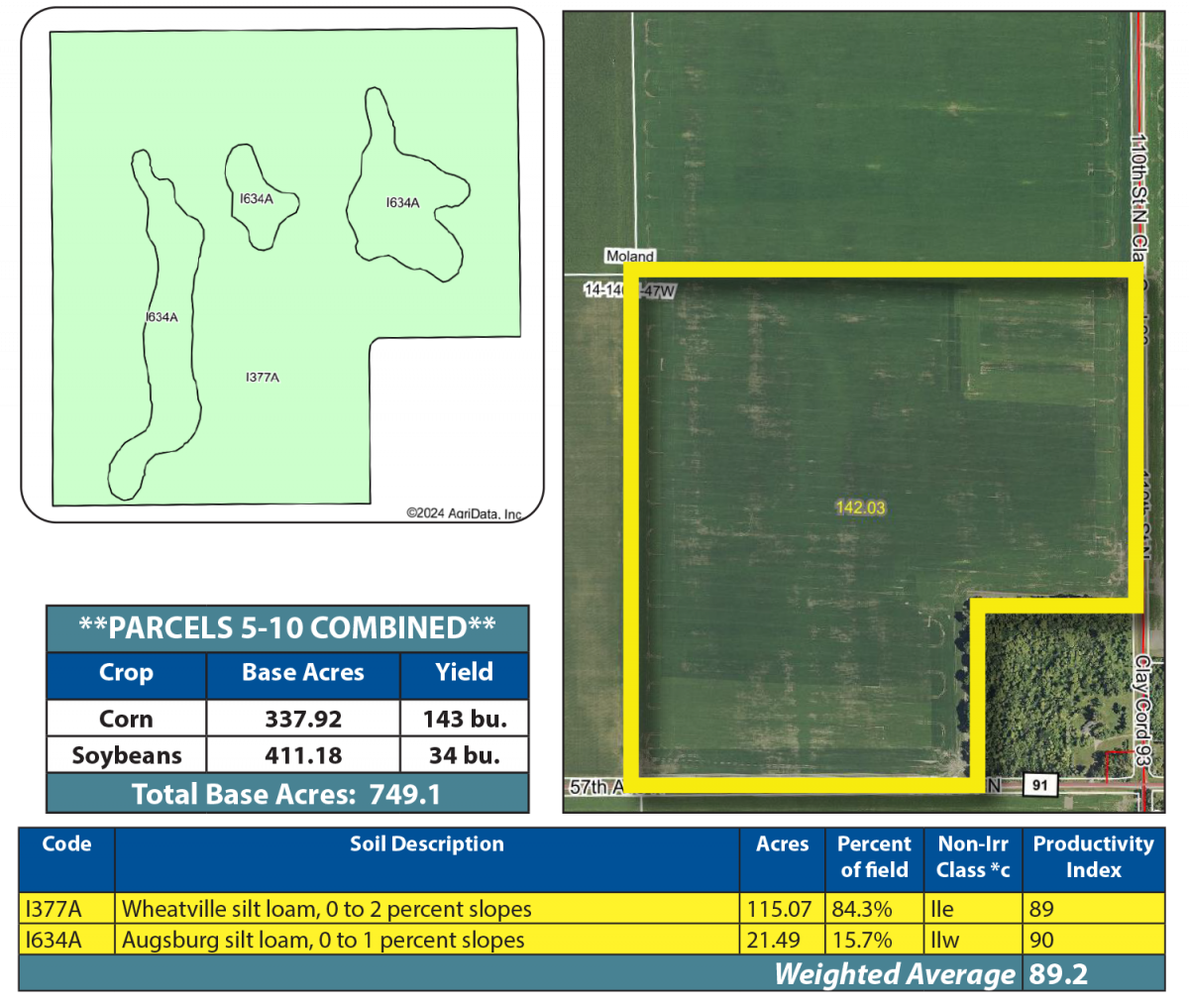

Parcel 6

Acres: 142.03 +/-

Legal: SE¼ Less 17.97 Acres 14-140-47

FSA Crop Acres: 136.56 +/-

Taxes (2024): $6,578.00

This parcel was planted to corn in 2024 and has an SPI of 89.2.

Parcel 7

Acres: 258.49 +/- (Estimate)

Legal: W½ Lying West of RR in 13-140-47

FSA Crop Acres: 252.1 +/-

Taxes (2024): $7,228.00

This parcel was planted to soybeans in 2024 and has an SPI of 89.1.

If sold separately from parcel 8, this parcel will be surveyed. Final acres and legal description will be determined by survey.

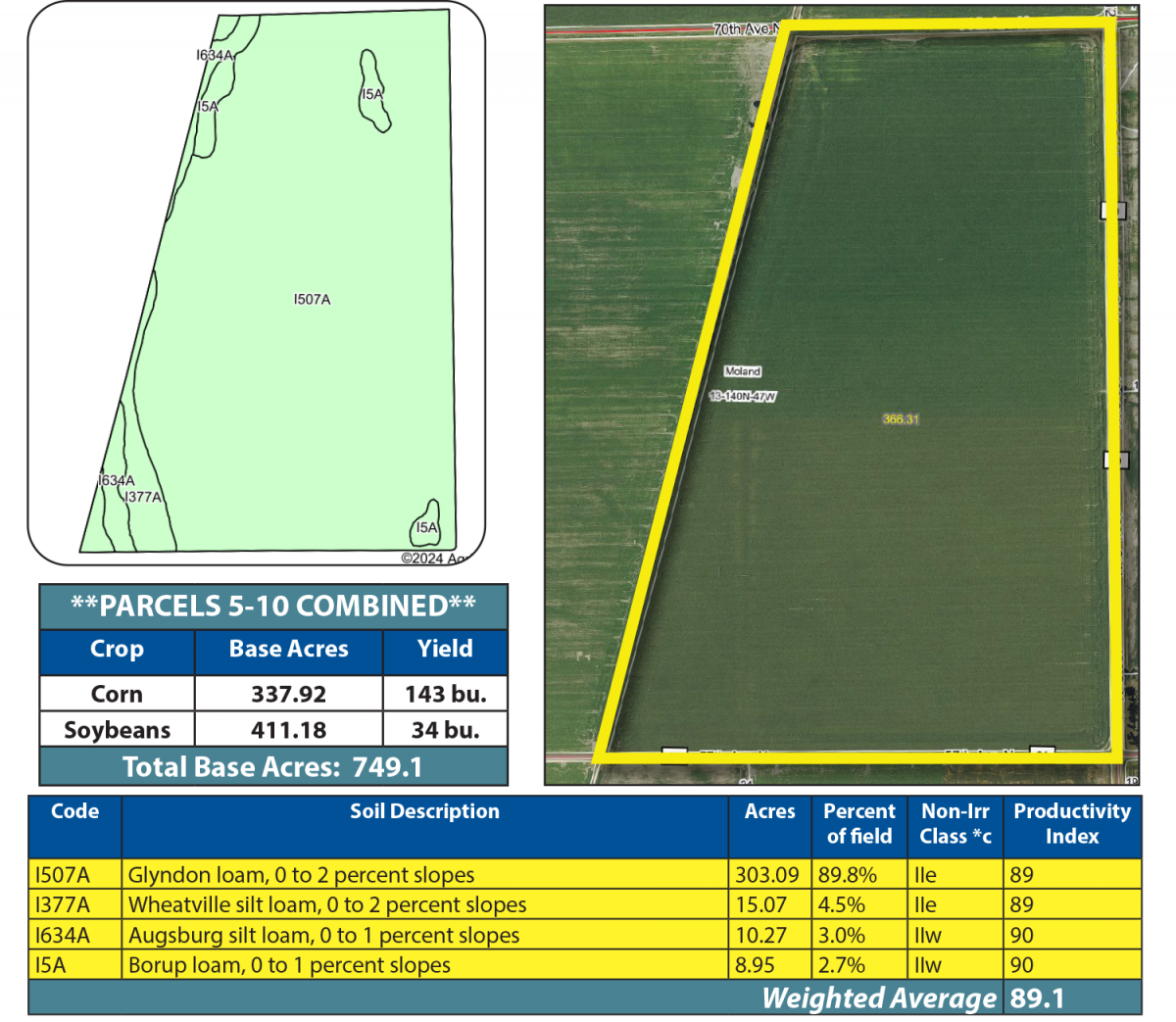

Parcel 8

Acres: 366.31 +/- (Estimate)

Legal: E½ Lying East of RR in 13-140-47

FSA Crop Acres: 337.38 +/-

Taxes (2024): $14,604.00

This parcel was planted to corn and sugarbeets in 2024 and has an SPI of 89.1.

If sold separately from parcel 7, this parcel will be surveyed. Final acres and legal description will be determined by survey.

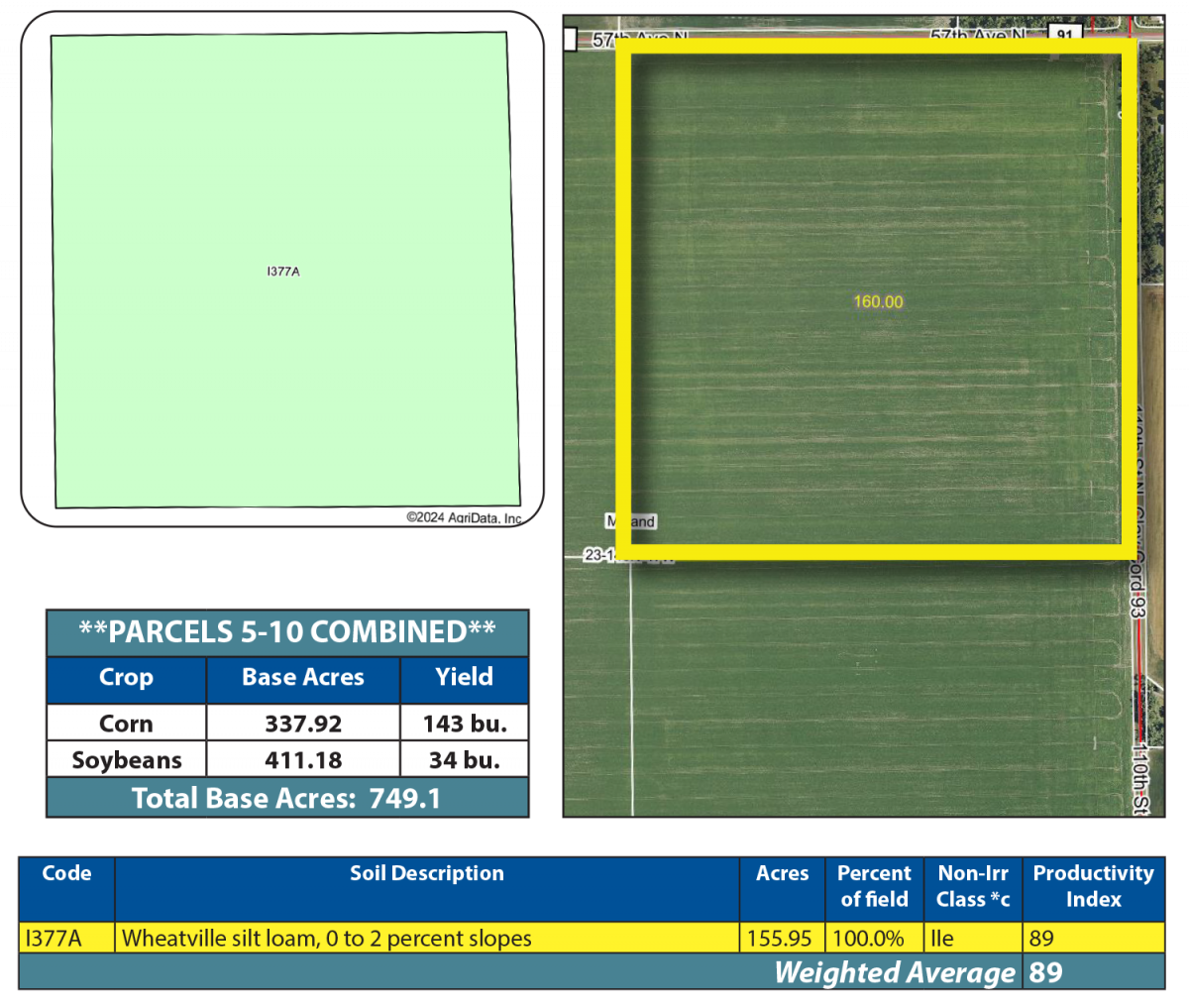

Parcel 9

Acres: 160 +/-

Legal: NE¼ 23-140-47

FSA Crop Acres: 155.95 +/- (Estimate)

Taxes (2024): $15,580.00 (Combined with Parcel 10)

This parcel was planted to soybeans in 2024 and has an SPI of 89.

Parcel 10

Acres: 160 +/-

Legal: SE¼ 23-140-47

FSA Crop Acres: 153.5 +/- (Estimate)

Taxes (2024): $15,580.00 (Combined with Parcel 10)

This parcel was planted to soybeans in 2024 and has an SPI of 89.1.

OWNER: Grover Farms Inc.

Toll Free: 1-877-700-4099

Toll Free: 1-877-700-4099